All Categories

Featured

Table of Contents

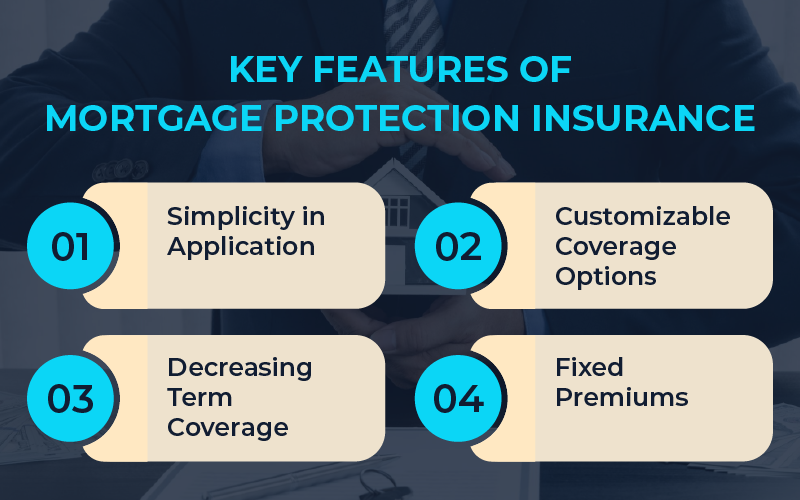

This policy firmly aligns with your mortgage. In fact, when individuals claim "home mortgage defense life insurance" they have a tendency to suggest this one. With this plan, your cover amount reduces gradually to reflect the reducing sum total you owe on your home mortgage. You may start your policy covered for 250,000, however by year 10 your policy may cover 150,000, because that's what your home loan is after that worth.

To see if you might conserve money with reducing term life insurance policy, demand a callback from a LifeSearch specialist today. To learn more click on this link or see our mortgage protection insurance home web page. Yes it does. The factor of mortgage protection is to cover the expense of your home mortgage if you're not about to pay it.

You can relax very easy that if something happens to you your home loan will be paid. Life insurance and home mortgage defense can be almost one in the very same.

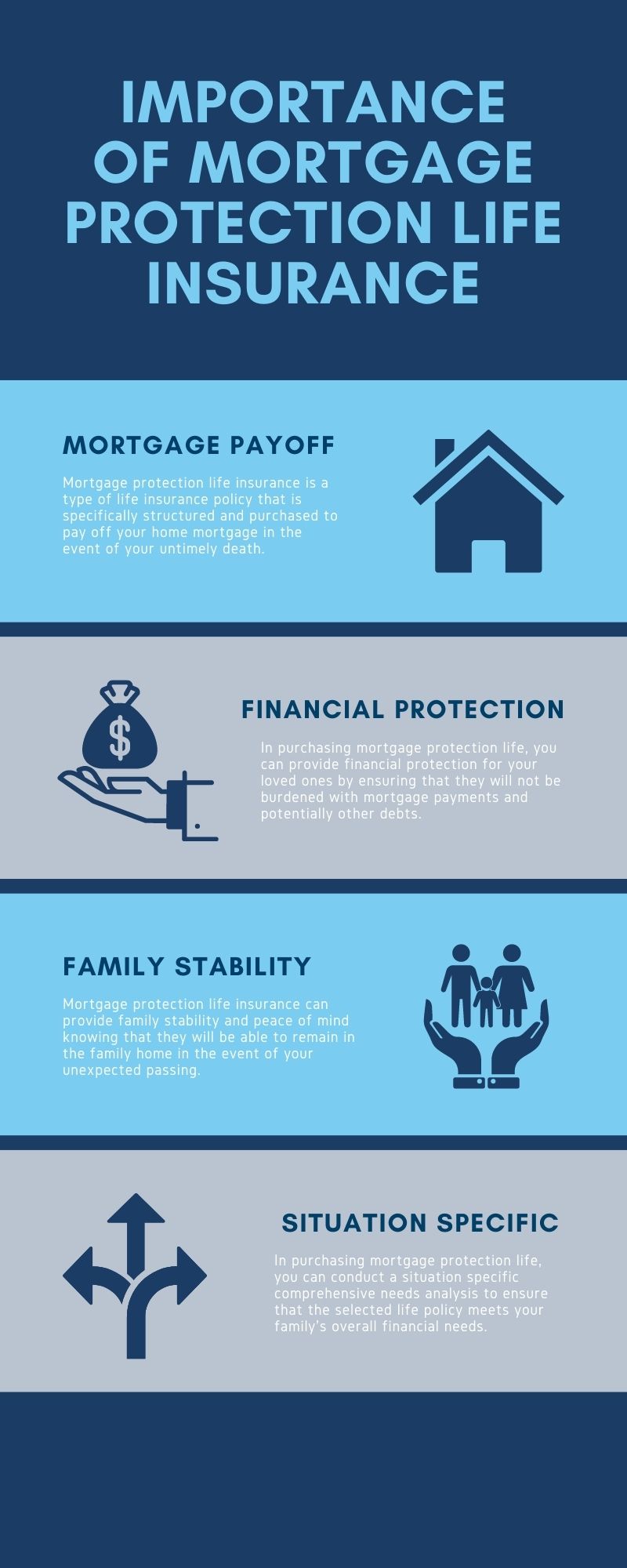

The lump amount payment goes to your loved ones, and they may pick not to clear the home loan with it. It depends if you still want to leave money for enjoyed ones when you die. If your mortgage is clear, you're greatly debt-free, and have no economic dependents, life insurance policy or illness cover may really feel unneeded.

If you're home mortgage cost-free, and heading into old age territory, it's worth looking obtaining recommendations. Crucial illness cover could be relevant, as can over 50s cover. It relies on the worth of your home loan, your age, your health and wellness, family dimension, way of life, pastimes and situations generally. While there are way too many variables to be precise in answering this concern, you can discover some generic examples on our life insurance and home mortgage protection pages - underwater mortgage protection.

Life insurance coverage exists to shield you. The ideal plan for you depends on where you are, what's going on at home, your health and wellness, your plans, your requirements and your budget.

Insurance Home Loan

This indicates that every one of the remaining mortgage at the time of the fatality can be totally settled. The affordable is due to the payment and liability to the insurer minimizing in time (best mortgage insurance uk). In the early years, when the fatality payment would certainly be highest, you are generally healthier and much less most likely to die

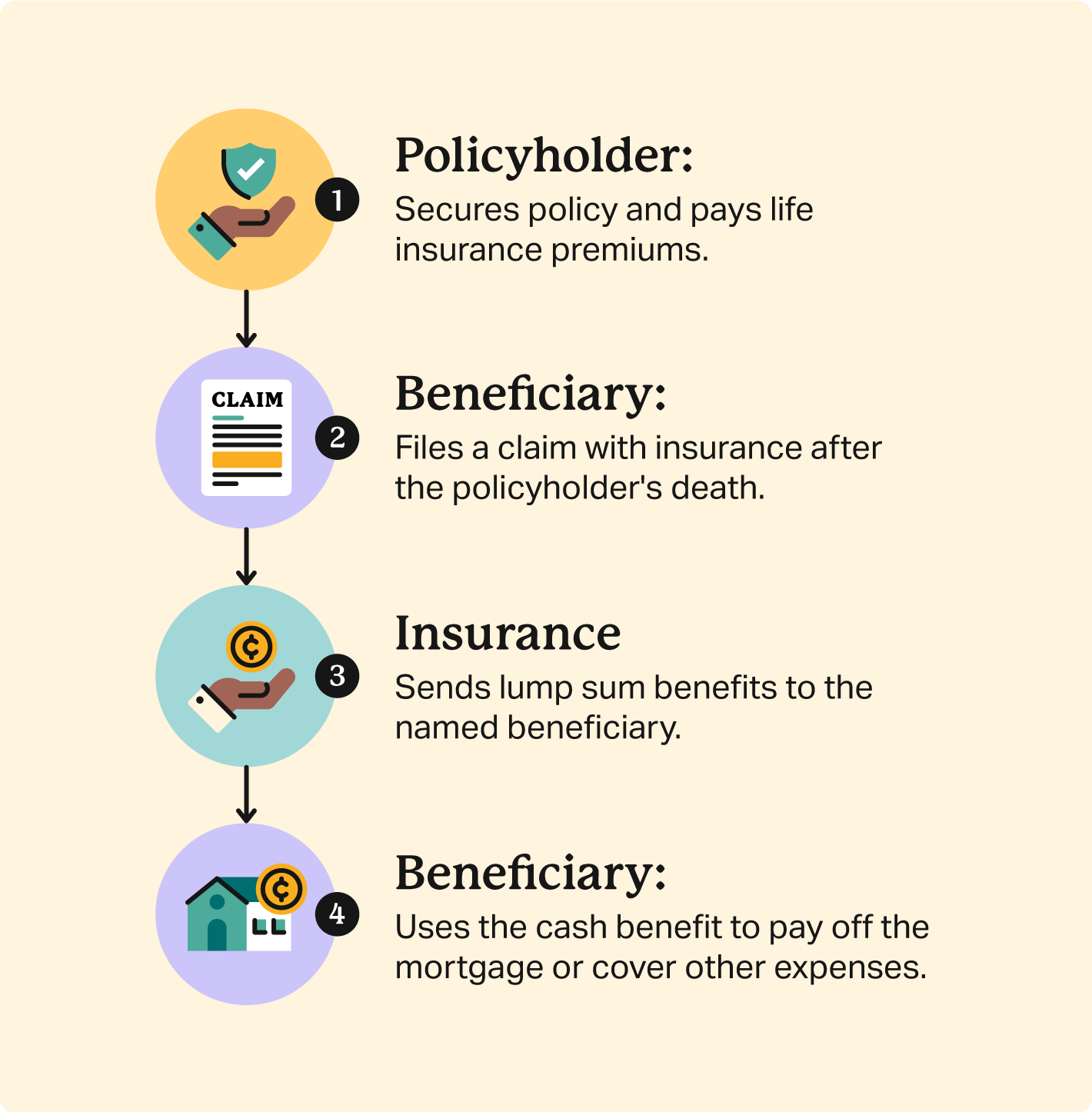

The benefits are paid by the insurance business to either the estate or to the beneficiaries of the person that has died. The 'estate' is every little thing they owned and leave behind when they pass away. The 'recipients' are those qualified to a person's estate, whether a Will has actually been left or not.

They can then continue to live in the home without more mortgage settlements. Plans can also be organized in joint names and would certainly after that pay on the very first fatality throughout the mortgage term. The benefit would go directly to the making it through companion, not the estate of the deceased person.

Mortgage Coverage Insurance

The strategy would certainly after that pay the sum insured upon diagnosis of the strategy owner suffering a major illness. These include cardiovascular disease, cancer, a stroke, kidney failing, heart bypass surgical treatment, coma, total permanent handicap and an array of other serious conditions. Regular monthly premiums are typically dealt with from beginning for the life of the strategy.

The premiums can be affected by bad wellness, lifestyle factors (e.g. smoking or being overweight) and profession or hobbies. The rates of interest to be billed on the home loan is also essential. The strategies usually assure to settle the superior quantity as long as a specific rate of interest is not surpassed during the life of the loan.

Home loan defense strategies can give easy defense in instance of sudden death or important illness for the outstanding home mortgage quantity. This is typically the majority of people's biggest regular monthly financial expenditure (insurance to pay off mortgage if i die). However, they ought to not be considered as ample security for every one of your situations, and various other types of cover may additionally be required.

We will review your insurance policy needs as part of the mortgage suggestions procedure. We can then make suggestions to fulfill your requirements and your spending plan for life cover.

Acquisition a term life insurance plan for at the very least the amount of your mortgage. They can make use of the earnings to pay off the mortgage.

State Farm Mortgage Protection Insurance

If your mortgage has a low passion rate, they may want to settle high-interest charge card financial debt and maintain the lower-interest home mortgage. Or they might wish to spend for home upkeep and upkeep. Whatever they decide to do, that cash will certainly come in handy. Utilize our life insurance policy tool. mortgage protection life insurance program to aid you obtain a quote of the amount of coverage you might require, and just how much a home loan life insurance quote might cost.

Find out various other means that life insurance can assist safeguard your and your family members.

Approval is ensured, no matter health and wellness if you are in between the ages of 18 and 69. No health concerns or medical examinations. The inexpensive monthly premiums will never ever increase for any kind of reason. Rates as reduced as $5.50 per month. For every single year the Policy remains continuously in pressure, primary insured's Principal Benefit will instantly be enhanced by 5% of the First Principal Benefit until the Principal Benefit amounts to 125% of the Initial Principal Advantage, or the key insured turns age 70, whichever is earlier. mortgage unemployment protection insurance providers.

Life Insurance Mortgage Protection Cover

Lots of people at some time in their lives struggle with their finances. In today's economic climate, it's more common than ever. "Just exactly how secure is my home?" It's a concern several of us don't believe to ask till after a crash has actually already taken place. World Life is ranked A (Exceptional)**by A.M.

For the majority of people, term life insurance policy uses extra robust insurance coverage than MPI and can likewise be utilized to pay off your home loan in the occasion of your death. Home loan life insurance coverage is developed to cover the equilibrium on your home loan if you die prior to paying it completely. The payment from the policy reduces with time as your mortgage equilibrium drops.

The death benefit from an MPI goes straight to your home mortgage loan provider, not your household, so they would not be able to make use of the payment for any kind of other financial obligations or expenses. There are less expensive choices readily available.

Who Provides Mortgage Insurance

The death benefit: Your MPI survivor benefit lowers as you settle your home loan, while term life policies most frequently have a level survivor benefit. This implies that the protection quantity of term life insurance policy stays the exact same for the entire duration policy. Mortgage security insurance policy is commonly confused with private mortgage insurance coverage (PMI).

However, entire life is dramatically more expensive than term life. "Term life is incredibly important for any private they can have college fundings, they may be married and have youngsters, they might be solitary and have charge card car loans," Ruiz stated. "Term life insurance coverage makes good sense for lots of people, yet some individuals want both" term life and whole life insurance coverage.

Otherwise, a term life insurance coverage plan likely will supply even more flexibility at a more affordable price."There are people who do both [MPI and term life] since they wish to make certain that their home mortgage earns money off. It can likewise depend on who the beneficiaries are," Ruiz said." [It's eventually] up to what kind of protection and just how much [protection] you want - mortgage protection department."If you're not exactly sure which sort of life insurance coverage is best for your situation, speaking to an independent broker can aid.

The only criterion "exemption" is for self-destruction within the initial 13 months of establishing up the plan. Like life insurance policy, home loan security is quite simple.

Latest Posts

Family Burial Insurance

Starting A Funeral Insurance Company

Funeral And Life Cover